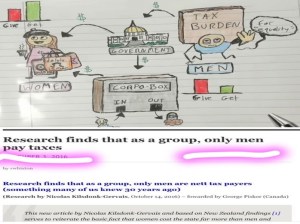

Very few women are actually economically sufficient

The state subsidizes and hides that fact from women; it is taking taxes from men.

This alters things greatly, and is an abstraction that relatively few females will (or can) grasp — and certainly when it’s not in their perceived interest to know it.

(Indeed. Many of us knew this 30 years ago)

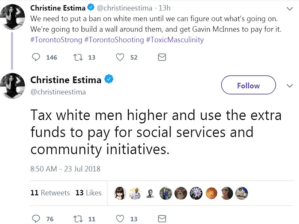

The second image (below) is a demand for a husband without ANY accountability to him.

If we did not live in such a moral (White) and altruistic society, this kind of comment and woman would never exist in any significant number.

She would have died long before uttering such naivety.

And … in Muslim societies they do.

The Muzzies … they seem to have no feminism related problem.

Christine Estima is Syrian Women living in … Canada.

She took flight from the Muslim World.

There she wrote The Syrian Ladies Benevolent Society”.

NAMED ONE OF THE BEST BOOKS OF 2023 BY THE CBC (Canadian Broadcasting Corp.)

Indelible linked stories centered around Azurée, a young Arab woman living in the echoes of her ancestors’ voices. Masterfully tracing the deep roots of the Arab immigrant experience, these interlocking stories follow an Arab family as they flee the Middle East in the nineteenth (what???) century, settle in Montreal in the twentieth, and face the collision between tradition and modernity in the twenty-first.

The Bitch has siphoned off (refugees get a LOT of money in Canada) wealth from hard working White men and wants to ban them until she/they (women) figure out what going on?

SEND HER BACK!

From Gab

Woman and Socialism

She is a clueless clown.

They love daddy government with their heels in their hoop earrings !

God’s design is made perverse by evil men. They problem is the selfish lack of God-fearing people.

Good Hoe Math cartoon.

Hoe! Hoe! Hoe! indeed.

This below is from DEEPSEEK (the Chinese AI).

DeepSeek is an AI LESS controlled by the left-wing totalitarian taboos that still reign in the West.

But not totally free …

DEEPSEEK cannot say (because it relies on info on the Web) that Men earn more because they WORK MORE and they work in MORE DANGEROUS occupations; fisherwomen (Har! Har! Har!); Lumber Jackeline (Har! Har! Har!), mining women (Har! Har! Har!); female firefighters do NOT go up the ladder to fight fires; female police offers do not because they cannot tackle and arrest strong violent offenders; female soldiers cannot pass a gender-blind military basic training course and they can’t fight at the front, etc., etc., etc.

The Core Reasons Why Men Pay the Majority of Taxes

“Progressive” Income Tax… meaning higher earners pay a higher percentage of their income in tax.

Gender Pay and Wealth Gaps: Men, on average, earn significantly more than women and hold a substantially larger share of total wealth.

Concentration at the Top: Men are overwhelmingly overrepresented in the highest income brackets and among the largest holders of wealth.

Who Pays What?

Income Tax Men by a large margin … dominate the highest income brackets, which are taxed at higher rates and contribute the most revenue.

Capital Gains Tax Men (overwhelming margin) … hold the vast majority of financial assets and investment wealth.

Corporate Tax Men are the majority of company owners, shareholders, and CEOs.

Sales Tax / VAT In absolute money, men pay more because they have higher consumption.

Property Tax Men … hold more property wealth and are … the primary owner on deeds.

DeepSeek’s full answer:

men pay most of the taxes, not women

This is a complex topic rooted in economics and demography, not a simple statement of fact. The key idea is not that individual men pay more tax than individual women, but that men, as a group, are the primary contributors to government tax revenue in most countries.

This outcome is driven by several structural factors, and it’s demonstrated through economic data on income, wealth, and tax collection. Here are the studies and data points that illustrate this phenomenon.

The Core Reasons Why Men Pay the Majority of Taxes

1. The Progressivity of Income Tax Systems: Most developed nations have a progressive income tax, meaning higher earners pay a higher percentage of their income in tax.

2. The Gender Pay and Wealth Gaps: Men, on average, earn significantly more than women and hold a substantially larger share of total wealth.

3. The Concentration at the Top: Men are overwhelmingly overrepresented in the highest income brackets and among the largest holders of wealth.

When you combine these factors, it becomes a mathematical inevitability that men will pay the lion’s share of income tax, capital gains tax, and corporate tax (which ultimately stems from ownership and investment).

Key Studies and Data Demonstrating This

1. Analysis of Income Tax Data by Gender

United Kingdom:

The UK’s HM Revenue & Customs (HMRC) publishes detailed statistics that are frequently analyzed by groups like the Institute for Fiscal Studies (IFS).

Finding: A landmark 2019 analysis by the IFS showed that the top 1% of income taxpayers (by income) in the UK are overwhelmingly male (87%) and contribute nearly 30% of all income tax revenue.

Interpretation: Since men dominate the highest income deciles where tax rates are highest, they contribute a disproportionately large share of total income tax collected. The bottom 50% of earners, who are more gender-balanced, contribute a very small fraction of total income tax.

United States:

The Internal Revenue Service (IRS) publishes data on tax collections by income bracket. While it doesn’t break it down by gender, other research institutes fill the gap.

Finding: Analysis by the Tax Foundation and others consistently shows that the top 1% and top 10% of earners pay the majority of federal income taxes. Given the significant gender gap in top earnings (e.g., men make up over 80% of taxpayers earning over $500,000), it follows that men pay the bulk of these taxes.

Data Point: In 2020, the top 1% of taxpayers paid 42.3% of all federal income taxes, while the bottom 50% paid just 2.3%.

2. Analysis of the Entire Tax System (Direct and Indirect Taxes)

While men pay most of the direct, progressive taxes (like income tax), the picture for indirect, regressive taxes (like sales tax or VAT) is different.

Study: The UK Women’s Budget Group has published analyses showing that while the richest households (disproportionately headed by men) pay the most in absolute terms for all taxes, the tax system as a whole is less progressive when you include indirect taxes.

Key Insight: Their research shows that women, particularly single mothers and low-income women, pay a higher proportion of their income in indirect taxes than men in similar circumstances. However, in absolute monetary terms, men still contribute the vast majority of the total tax revenue because of their vastly higher incomes and spending power.

3. Analysis of Wealth and Capital Gains Taxes

This is perhaps the most significant area of disparity.

Global Wealth Data: According to reports from Credit Suisse and Oxfam, men own 50% more of the world’s total wealth than women. In some regions, the gap is over 100%.

Billionaire Lists: Men consistently make up over 85-90% of the world’s billionaires.

Tax Implication: Wealth generates income through investments (capital gains, dividends, interest). Taxes on this investment income (Capital Gains Tax, Corporate Tax on dividends) are therefore paid overwhelmingly by men, as they own the majority of the assets.

Summary Table: Who Pays What?

Tax Type Who Pays More (in Total Revenue)? Primary Reason

Income Tax Men by a large margin Men dominate the highest income brackets, which are taxed at higher rates and contribute the most revenue.

Capital Gains Tax Men by an overwhelming margin Men hold the vast majority of financial assets and investment wealth.

Corporate Tax Men (indirectly) Men are the majority of company owners, shareholders, and CEOs. The burden of the tax ultimately falls on capital.

Sales Tax / VAT More Mixed In absolute money, men pay more because they have higher consumption. As a percentage of income, poorer women often pay more due to the regressive nature of these taxes.

Property Tax Men Men, on average, hold more property wealth and are more likely to be the primary owner on deeds.

Important Nuances and Counterpoints

It is crucial to understand what this data does not mean:

1. It’s Not About Individual Men vs. Women: This is a group-level analysis. A high-earning woman will pay more tax than a low-earning man. The point is that, in aggregate, the group “men” are the primary funders of the state.

2. It Reflects Systemic Inequality: The fact that men pay most of the taxes is a symptom of the same gender inequalities that harm women—the gender pay gap, the concentration of men in top corporate positions, and the gender wealth gap.

3. Who Benefits from Spending? A complete analysis must also look at government spending. Certain social programs, healthcare, and education benefits may disproportionately be used by women, partly offsetting the tax contribution imbalance.

Conclusion:

Numerous studies from government statistical agencies (like HMRC), economic think tanks (like the IFS, Tax Foundation), and gender budget groups demonstrate that men pay the majority of taxes. This is not due to tax law itself being gendered, but is a direct consequence of men earning more and holding more wealth than women, placing them in higher tax brackets and making them the primary source of revenue from taxes on income, capital gains, and wealth.

You must be logged in to post a comment.